The real estate market in India has slowly but surely bounced back in a major way after the pandemic. The year 2022 proved to be a fantastic year for the real estate market in the country. The nation witnessed significant new launches and home sales that did a considerable performance.

The real estate market is considered to be immune to the vitality of the market. They are believed to have stayed true to the expectations of real estate investors despite the highs and the lows in the last couple of years. However, positive expectations and a surge in the momentum of development have showcased the market’s ability to stay put and will continue to perform in 2023 and the following years as well.

Let’s take a look at the real estate trends that are emerging in 2023:

Shop-Cum-Offices in Commercial Real Estate Sector

One of the emerging real estate trends this year is shop-cum-offices. Also referred to as SCO, it is a commercial real estate class that has witnessed huge development in the last couple of years. When it comes to locations, Gurugram is renowned for being the most popular and lucrative destination for shop-cum-offices in the NCR. SCO plots are available for development as well as investment in numerous areas of Gurugram. Due to this, a new era of commercial SCO plots has come up. Fortunately, SCO markets have witnessed massive development and the early investors’ capital has increased numerous times well.

House Hunting is Now Digital

When it comes to real estate trends, housing hunting going digital is one of them. While digital platforms have existed for a long time, the requirement for them has increased multifold, especially during and after the pandemic. For some time, many people have made their home bookings while using a digital platform. Moreover, other factors included in the home-buying process are a home tour, brokerage amount, rent amount, lease agreement, deposit amount, and so forth, have gone digital as well. Moreover, home loans can now be made online too. This can be the basis for buying and selling real estate projects in 2023.

Sellers’ Market

The upcoming housing market in 2023 will be observed as a sellers’ market. It is expected that the rates of the housing market will increase for some time owing to the increasing demand for homes combined with limited supply. It is said that Generation Y will be initiating real estate investments for the first time this year. Accordingly, the housing demand for residential and commercial spaces will witness a surge as well. When it comes to the future of the real estate market in India, it will be signified by a rise in demand and a limited supply, thereby creating a seller’s market.

Tier-II Cities Becoming Residential Markets

A rise in the proportion of investments will be shifting to tier-II and tier-III cities in 2023 are one of the real estate trends observed. Specific government programmes including AMRUT and Smart Cities Mission have aided these cities and turned them into amazing residential hubs. Additionally, with a rise in job opportunities and economic development, these cities are more likely to have a more solid residential population. Moreover, numerous tier-II and tier-III cities are either home to a few Indian as well as international MNCs or are well-connected to cosmopolitan cities of India. This, in turn, will result in residents shifting to tier-II and tier-III cities and travelling for work daily.

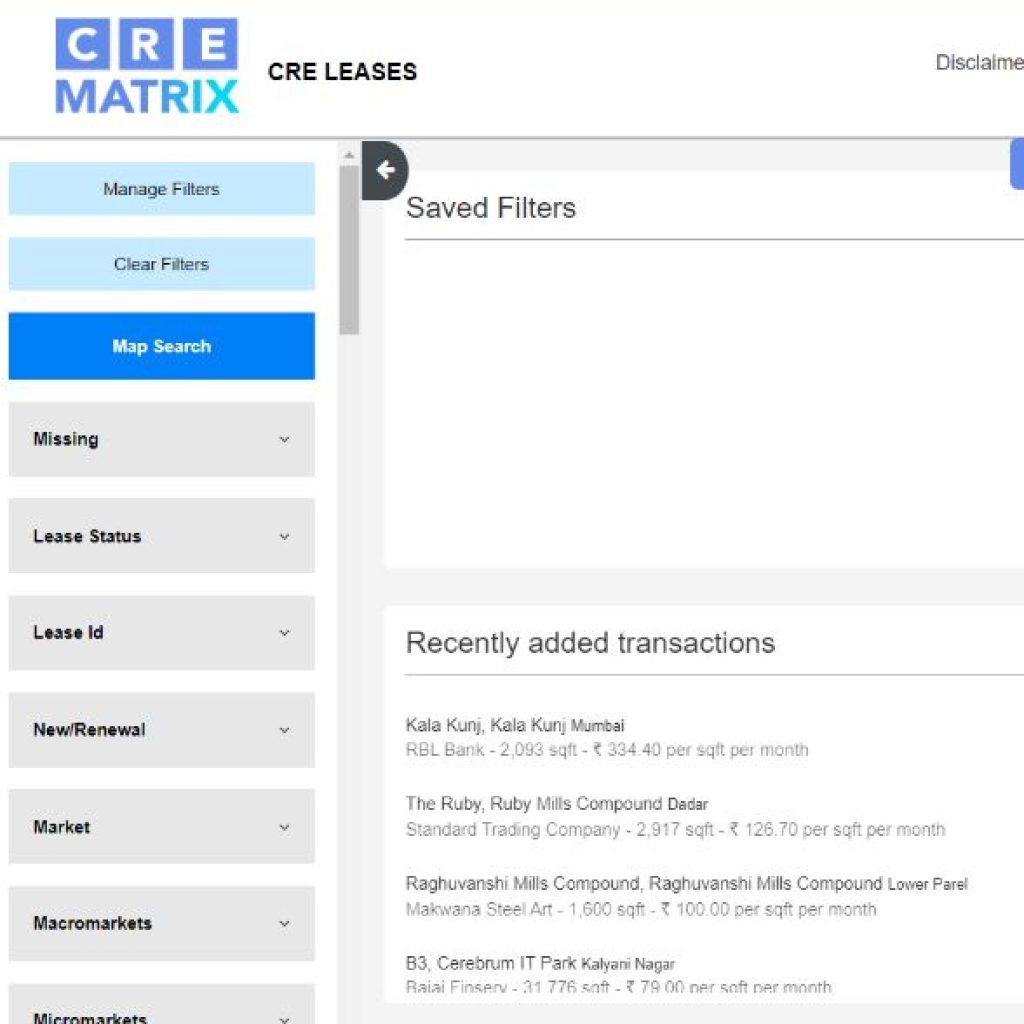

In a nutshell, above mentioned are some of the major real estate trends that are emerging in 2023. If you wish to know more real estate insights, then head over to CRE Matrix, a leading real estate data analytics firm in India that offers authentic information on the real estate market in India.