Investing in real estate is one of the most important financial commitments you can make, and if you do it correctly, it can alter you entire life. Real estate investment in India can have its benefits as well as downfalls. Making the right choice can enable you to achieve your goals, while making the wrong choice make your finances as well as other issues worse. This is why, you need to be informed when you decide to pick the correct option and amplify the rewards of your investment.

It’s difficult to pin point which of the top 20 cities in India are good for real estate investment, as it can depend on numerous factors including current market conditions, infrastructure development, and government policies. Parameters that are taken into consideration when deciding the top cities for real estate investment in India comprise of include the strength of the local economy, population growth, and the steadiness of the real estate market, among many others.

Moreover, factors relating to proximity to amenities and transportation, local zoning laws as well as the availability of financing can also play a significant role in deciding whether a particular city is a good place to invest in property. However, a couple of the cities that is typically worthy options for real estate investment in India are:

Mumbai: Dubbed as the financial capital of India, Mumbai has a powerful economy and a flourishing real estate market.

Delhi: As the capital city of India, it has a large population and a developing economy, thereby making it a famous destination for real estate investment in India.

Bengaluru: It is the IT capital of India. Bengaluru has a huge amount of job opportunities and a large population, thereby making it a great destination for real estate investment in India.

Pune: Renowned for its pleasant climate and proximity to the IT hub of Hinjewadi, Pune has emerged as a lucrative destination for property investment in the last couple of years.

Kolkata: It is the commercial as well as cultural capital of Eastern India. Kolkata is an incredible place if you’re looking for properties at budget-friendly rates.

Hyderabad: Renowned for its IT and biotechnology industries, Hyderabad has a developing economy and a huge number of job opportunities, thereby making it a great place for real estate investment in India.

Chennai: Known as a major industrial and cultural center, Chennai has a fast-growing economy and abundant job opportunities. This is why it would make for a good destination for real estate investment.

Ahmedabad: It is the largest city of Gujarat and is known for its abundant job opportunities. This makes it an excellent place for property investment.

Surat: Famed for its textile industries, Surat has a strong growing economy and a plethora of job opportunities. This makes it an incredible destination for real estate investment in India.

Jaipur: The pink city is known for its strong economy and a large number of job opportunities, particularly in the tourism sector, thanks to its heritage. This makes it a great destination for investment in property.

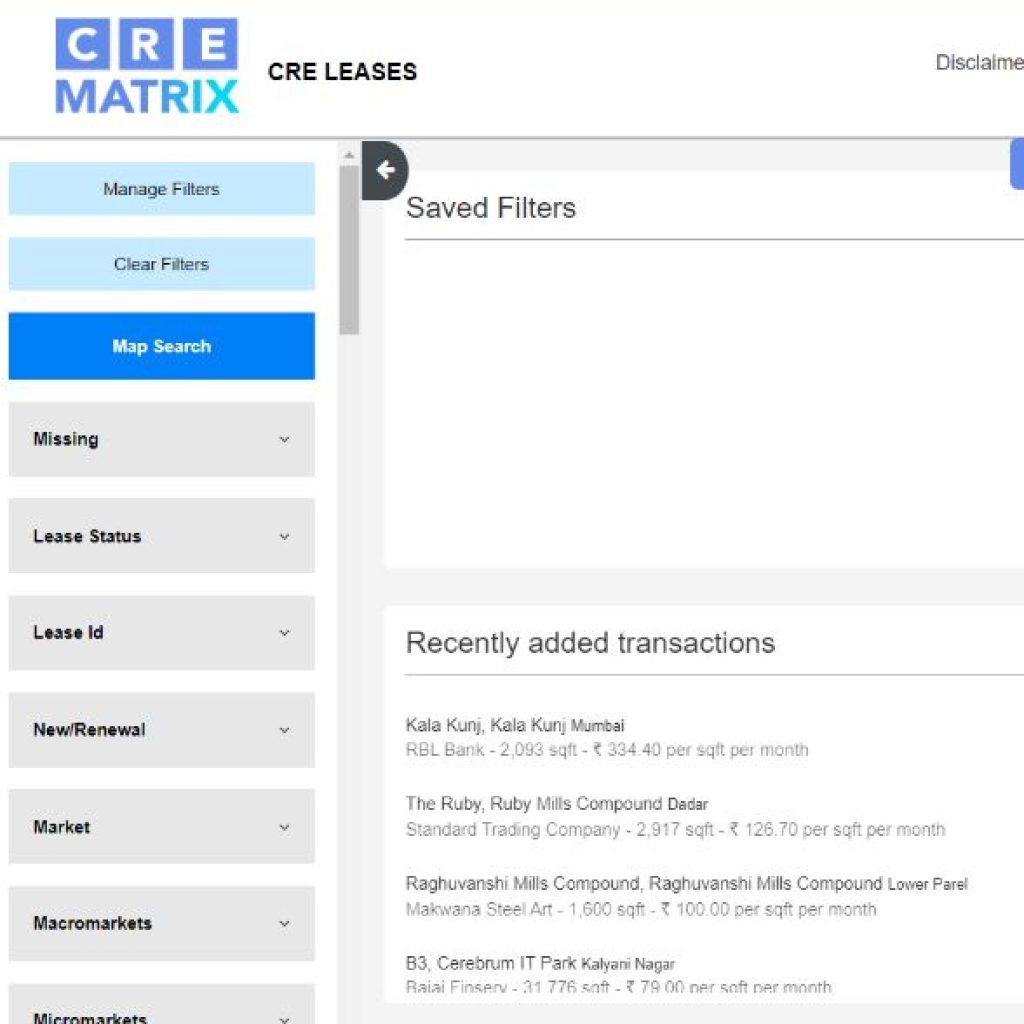

In a nutshell, these are top 10 cities that are excellent for real estate investment in India. If you wish to get real estate insights on a pan-India basis, then head over to CRE Matrix, a leading real estate data analytics company in India.